If you’re self-employed, you need to know about the Department of Labor’s new independent contractor rule set to go into effect on March 11, 2024. This rule threatens the livelihoods of tens of millions of self-employed Americans — including freelancers, independent contractors, franchisees, and owner-operators. The media landscape is cluttered with stories with a pro-union spin, ignoring the voices of the self-employed. This article addresses five things some media stories get wrong about the rule.

1) The rule doesn’t only impact gig workers

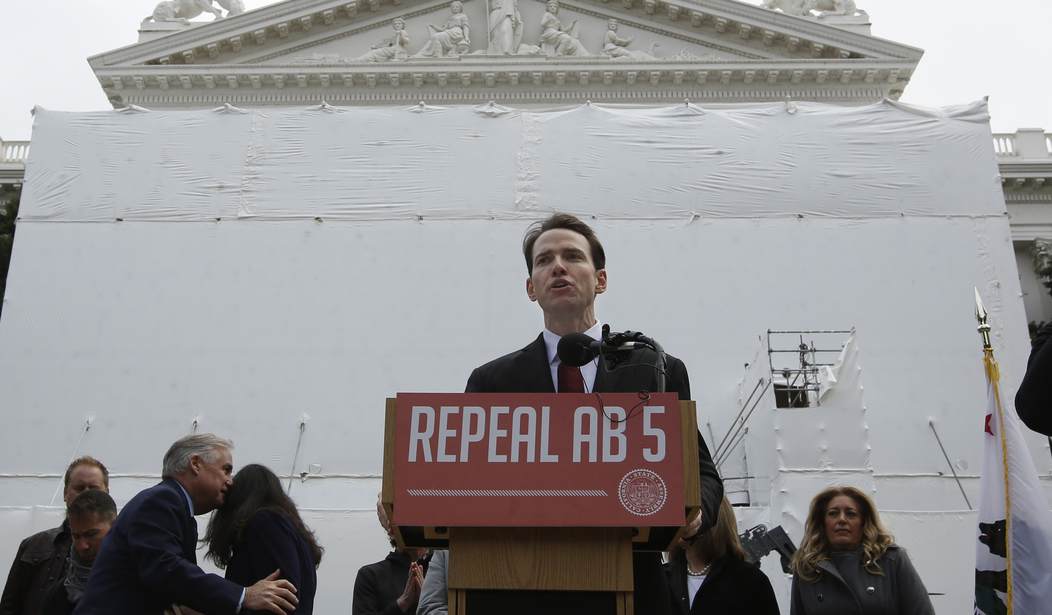

Some news stories say that the rule only impacts gig workers. It targets more than 72 million self-employed Americans, most working as independent contractors. App-based or gig-platform work represents a fraction of independent work. This rule impacts at least 600 professions, all highlighted in a speech on the House floor by Representative Kevin Kiley of California. If you’re self-employed, your occupation is likely on this list.

RELATED: Kevin Kiley Joins with CA Assembly Republicans to Fight the AB5-Inspired Independent Contractor Rule

2) Most independent contractors want to remain independent

Another angle many media stories take — that nearly all independent contractors are exploited, misclassified employees. Study after study shows that 63 percent to 75 percent of people who perform independent work do so by choice. Why do so many Americans prefer self-employment over traditional employment? The reasons vary widely and include:

The freedom to be your own boss — You decide how, when, where, and with whom you work. You also decide what to charge for your work. You control your business and career.

Schedule flexibility — You set your own hours. So, for example, you can take care of an elderly parent or work around serious health problems without the risk of losing your job.

Income stability — As an independent contractor, you typically have multiple clients. If you lose one or two of them, you’ll still have some income. If you lose your one employer, your income goes down to zero.

To avoid employment pitfalls — Running your own business means you can avoid common workplace problems like discrimination, toxic work environments, and micromanagement.

Most independent contractors will tell you that no amount of money would compel them to switch to traditional employment.

3) Businesses and independent contractors oppose the new rule

Some news stories say that only businesses oppose the new rule. However, the DOL received more than 55,000 public comments regarding it. The comments show that labor unions and worker advocacy groups support the rule while independent contractors and business entities oppose it.

In January, a business coalition filed a motion to renew its litigation challenging the DOL classification rule. That same month, the leaders of Fight for Freelancers USA filed a complaint in federal court through the Pacific Legal Foundation, asking that the court find the department’s rulemaking invalid. In February, the Liberty Justice Center and the Louisiana Pelican Center for Public Policy filed a lawsuit on behalf of a trucking business, seeking an injunction to prevent the rule’s enactment.

We already have laws that the DOL regularly uses to win worker misclassification cases, making the rule unwarranted and unnecessary.

RELATED: A Lawsuit Seeks to Stop the National Destruction of Trucking Through the DOL Indep. Contractor Rule

4) The rule creates classification confusion

Many media stories say that the rule will prevent worker misclassification. Instead, the rule creates widespread classification confusion. The Pacific Legal Foundation says about the rule:

“The DOL’s new rule deliberately prevents workers and businesses from knowing whether anyone is an independent contractor and exposes those who work with freelancers to huge fines and criminal penalties for not knowing.”

...

“The Supreme Court made clear in Sackett v. EPA (2023) that an agency cannot embrace a statutory interpretation with no useful guideposts without raising dire constitutional questions. The DOL’s rule is so freewheeling and open ended, it can’t be the correct interpretation of the Fair Labor Standards Act.”

The rule’s 300+ pages do not provide clarity on the classification of independent contractors vs. employees. Instead, they obfuscate classification so that businesses favor employee status to avoid the risk.

5) The rule will likely reduce self-employment and employment overall

Some media outlets claim the rule will boost traditional employment, bringing more workers benefits. Don’t count on it. You only need to look at California’s AB5 to see what will happen if this rule goes into effect. The Mercatus Center at George Mason University recently released a working paper outlining the impact of worker reclassification and the employment outcomes after AB5.

The research group estimates that in California after AB5, “self-employment fell by 10.5 percent on average, while overall employment fell by 4.4 percent on average.” In addition, “occupations with a greater prevalence of self-employed workers saw greater reductions in both self-employment and overall employment.”

The DOL wrote the rule so that it doesn’t look precisely like AB5. However, the agency states within the rule text that “there may be conceptual overlap between the Department’s proposed integral factor and Prong B of the ABC test.” Prong B contains the most damaging language to independent contractors in AB5. The outcomes from the rule will likely match that of post-AB5 California but on a nationwide scale.

RELATED: California's AB5 Goes National With the Independent Contractor Rule: Why You Need to Pay Attention

KILEY: The American Dream Is in Danger

The war on independent work

This new rule is part of a concerted effort by the Biden administration to significantly reduce or eliminate independent work. It has nothing to do with what independent contractors want and everything to do with what union leaders want — more members. By law, employees can unionize while independent contractors can’t. Data shows that independent work continues to rise while union membership continues to decline. Unions contribute millions to Democratic political campaigns, so as union membership dwindles, so do the funds available for Democrats. Expect more attempts at curbing independent work at the federal and state levels. So, if you don’t want to lose your right to self-employment, you must fight back with your best tool — your vote.

Janet Wagner has been a self-employed tech writer for more than ten years. For the past several years, she's been advocating to protect the choice of self-employment.

Join the conversation as a VIP Member