(The opinions expressed in guest op-eds are those of the writer and do not necessarily represent the views of RedState.com.)

The largest single financial gift to a university or college, as reported by a constant cohort of 555 colleges and universities in the U.S., was a $341 million tax-deductible gift to Stanford University in 2015.

That extraordinarily generous donation, by an alumnus no doubt, represented 9.1% of the total amount given in that year to all 555 schools in the cohort that reported such data.

On average, individuals, foundations, and corporations donate about $50 billion annually to more than 5000 colleges and universities in the United States. And this amount has consistently grown over the past 20 years.

The individual donors’ who make such large gifts have an average annual salary and net worths of $500,000 and $2 million, respectively. The $2 million figure doesn’t include the individual’s personal residence. It includes their stock portfolio, and other investments, including real estate.

Said another way, the 5000+ colleges and universities in America can expect to receive over $500 billion in private, tax-deductible gifts over the next decade. This is in addition to the roughly $700 billion they have sitting in university and college foundations today.

This of course begs the question; why are struggling, over-taxed working families being forced to subsidize these fabulously wealthy higher-education institutions by even a single penny?

Might it be time for all these wealthy university and college foundations to start sharing their wealth by paying down the costs of a 4-year education for those families who can’t afford to pay the cost?

And it seems to me this help should be specially made available to low-income students who have the grades to be accepted to a fine university and can prove their families lack the financial resources to pay the cost of tuition to attend.

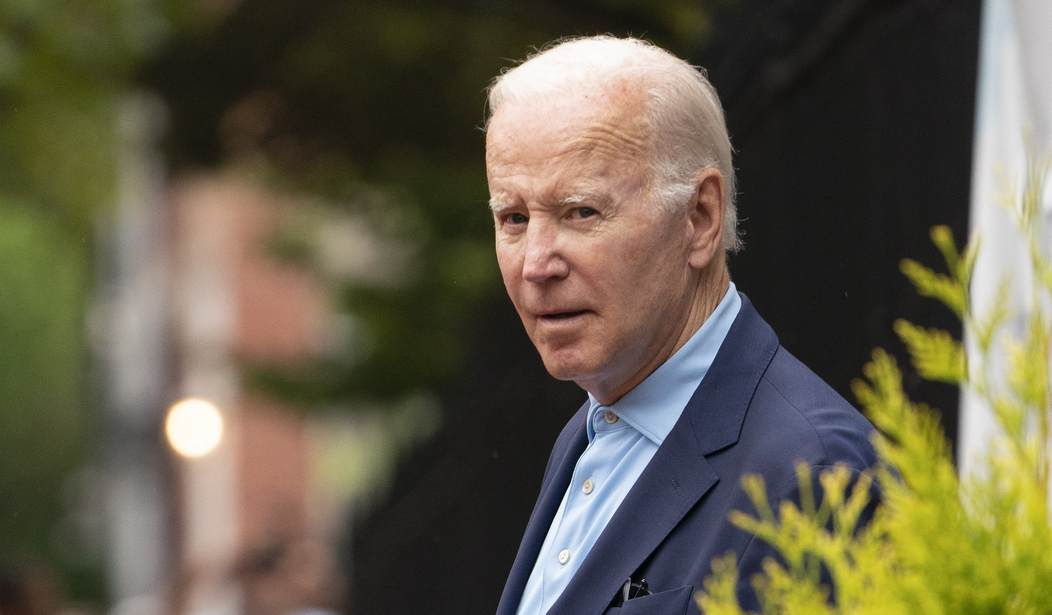

The loan forgiveness scheme, on the other hand, as proposed by the President, in what is almost certainly an overreach of his executive authority under the Constitution, makes these wealthy universities and college foundations even wealthier, not to mention also the investors and the financial institutions that own the debt.

Moreover, the president’s scheme will cause university and college tuition to rise even faster.

5000+ colleges and universities in America can expect to receive over $500 billion in private, tax-deductible gifts over the next decade…

What else should we expect these institutions of higher learning to do once they realize no matter what they charge our kids to attend their school, Uncle Sam will step in and guarantee the cost is covered?

We see the same phenomenon in the health care sector. With third-party payment arrangements, the incentive to control medical costs is minimal. Like with health care, higher education should be accessible to all, but consumer-driven to make sure the price isn’t beyond the reach of every family in America.

Transferring the cost to the taxpayers, including those taxpayers who can’t afford the tuition in the first place, will undoubtedly occur every time the need arises for President to pander to this particular demographic in the body politic, and for no other reason than for electoral gain.

No, it seems abundantly clear to me the money needed to advantage those members of our society who are worthy of investing in, education-wise, but lack the financial ability to invest in themselves, exists. But it doesn’t exist in Washington D.C., but, rather, in the many foundations that are currently sitting on over $700 billion in tax-deductible donations which grow by $50 billion every year.

Finally, it must be pointed out that too many of our kids seem to think that unless they attend a 4-year college or university their future won’t be a bright one. This is false. For most, if not an overwhelming majority of kids, community colleges are a perfectly suitable alternative. And they are far more affordable.

Community colleges typically charge half what a 4-year university charges. And it isn’t because you receive half the education. Indeed, as explained by Dr. Mark Perry, Senior Fellow Emeritus at the American Enterprise Institute, professors at community colleges aren’t under pressure to publish and don’t regularly attend expensive, four-day academic conferences in Costa Rica, Hawaii, and the Virgin Islands.

For the tens of millions of graduating high school seniors in America, a community college can prepare them for a future job or career just as well as an over-priced, elite 4-year university. And with only 50% of the financial outlay.

Not to mention these colleges are local and are increasingly a vital part of the local economic wellbeing of the cities where they exist. In Santa Barbara County, for example, both Santa Barbara City College, and Hancock College, are not only tremendous institutions, but both are vibrant and increasingly irreplaceable assets for our entire community.

PS: And just for the sake of seeking consistency, and economic sanity, forgiving student loans isn’t inflationary any more than public libraries cause people to write books.

Editor’s note: A prior version of this article stated that Dr. Mark Perry was Senior Fellow Emeritus at the Competitive Enterprise Institute. We have updated the article to reflect that Dr. Perry is Senior Fellow Emeritus at the American Enterprise Institute.

Joe Armendariz is the Director of Government Relations & Public Affairs for Armendariz Partners, LLC. He is the former Executive Director of the Santa Barbara County Taxpayers Association, Santa Barbara Technology and Industry Association and the Chairman of the California Center for Public Policy. His views are his own and do not necessarily represent the views of his former or current group affiliations. He can be reached at: 805.990-2494

Join the conversation as a VIP Member