At every turn, you hear Democrats trying to claim that the “rich” don’t “pay their fair share.”

Of course, that’s really code for: they want to impose more tax on all of us.

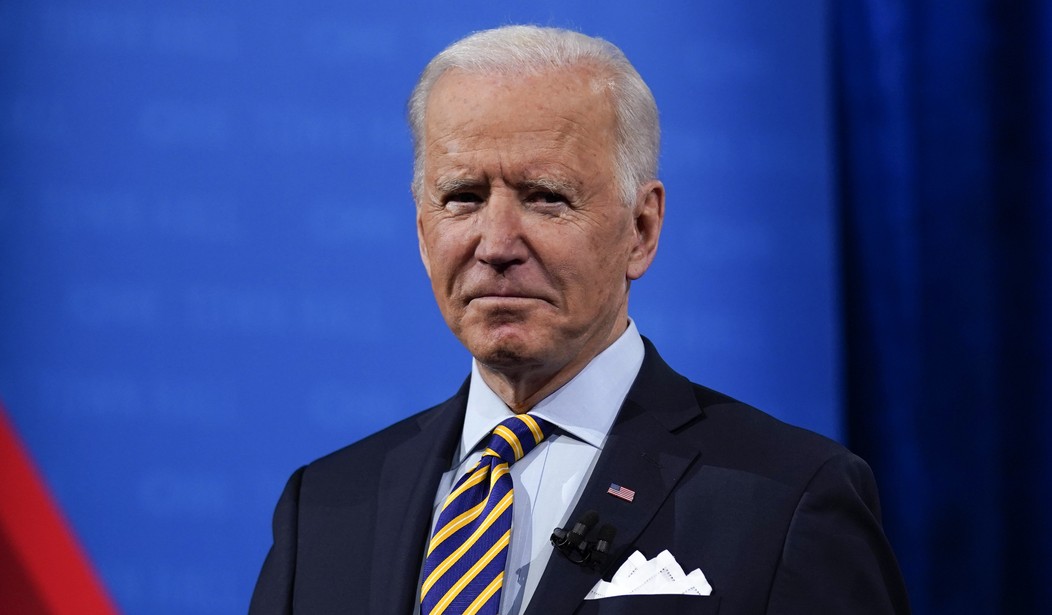

But let’s go along with their point for just a moment. As Fox observed, Joe Biden recently complained that “‘the wealthiest 1% of Americans saw their net worth increase by $4 trillion,’ he then ripped loopholes and deductions corporations used to dodge taxes.”

I’d like to point out that if Biden wants to talk about the person not “paying his fair share,” according to his own rationale, he should look in the mirror.

Republican Study Committee Chair Jim Banks (R-IN) ripped Biden, explaining how Biden had himself ducked taxes, using the very same provisions Biden argues should be eliminated.

As a private citizen in 2017, 2018 and 2019, Biden and first lady Jill Biden routed $13 million in income through two S-corporations – CelticCapri Corporation and the Giacoppa Corporation – to avoid paying taxes that help fund Medicare and the Affordable Care Act (ACA), better known as ObamaCare. While entirely legal, Biden has advocated eliminating such loopholes, while also promoting the expansion of both Medicare and ObamaCare.

The Banks letter to Biden asked, “Do you intend to undo your hypocrisy and pay these taxes back to the American people?”

“Press reports indicate that you both directed revenue from book royalties and speaking appearance fees into these two corporations avoiding self-employment payroll tax liabilities that would have flowed to America’s Medicare program that provides care to over 60 million seniors,” reads the letter, dated March 25.

Banks pointed out the hypocrisy of the Democrats, how they went after President Donald Trump to get his taxes, despite no allegations of any specific wrongdoing, and how Biden wants to impose more taxes but then you have Biden doing this. He also dropped the hint that if the GOP ever got back power they might have a lot more to say about Biden’s moves.

“The ACA imposed higher taxes on millions of Americans, but not Joe Biden. He paid $121,000 less in ObamaCare taxes thanks to an obscure tax loophole. Talk about inside baseball,” Banks told Fox News. “Joe Biden advocated for expanding Medicare, and is pushing to close tax loopholes and for a $3 trillion tax hike. At the same time, ‘Amtrak Joe’ made $13 million through speaking fees in just three years, then skimped over $500,000 from Medicare recipients through tax loopholes.”

The Wall Street Journal first reported the first couple’s tax move in July that saved them as much as $500,000. The newspaper said the Bidens avoided paying 3.8% in Medicare payroll taxes by moving book royalties and speaking-related income into an S-corporation.

Of course, while Biden is ducking paying, Medicare is facing “funding shortfalls,” Banks said.

RubinBrown LLP accountant Tony Nitti told the Wall Street Journal, “There’s no reason for these to be in an S corp — none, other than to save on self-employment tax.”

Americans for Tax Reform blasted Biden for avoiding paying 3.8% of the Medicare Payroll Tax, and the 0.9% of the Obamacare “Additional Medicare Tax” on the $13 million in alleged income, “This is clear hypocrisy as Biden supports expanding Obamacare and routinely says ‘the rich’ need to pay their fair share.” ATR said he not only used a loophole that the Obama administration fought to close but that he also avoided a tax that his administration in fact created.

Join the conversation as a VIP Member